We are happy to tell you that this new year brings new features and advantages in relation to tax deductions for donations to non-profit organizations, such as our Foundation:

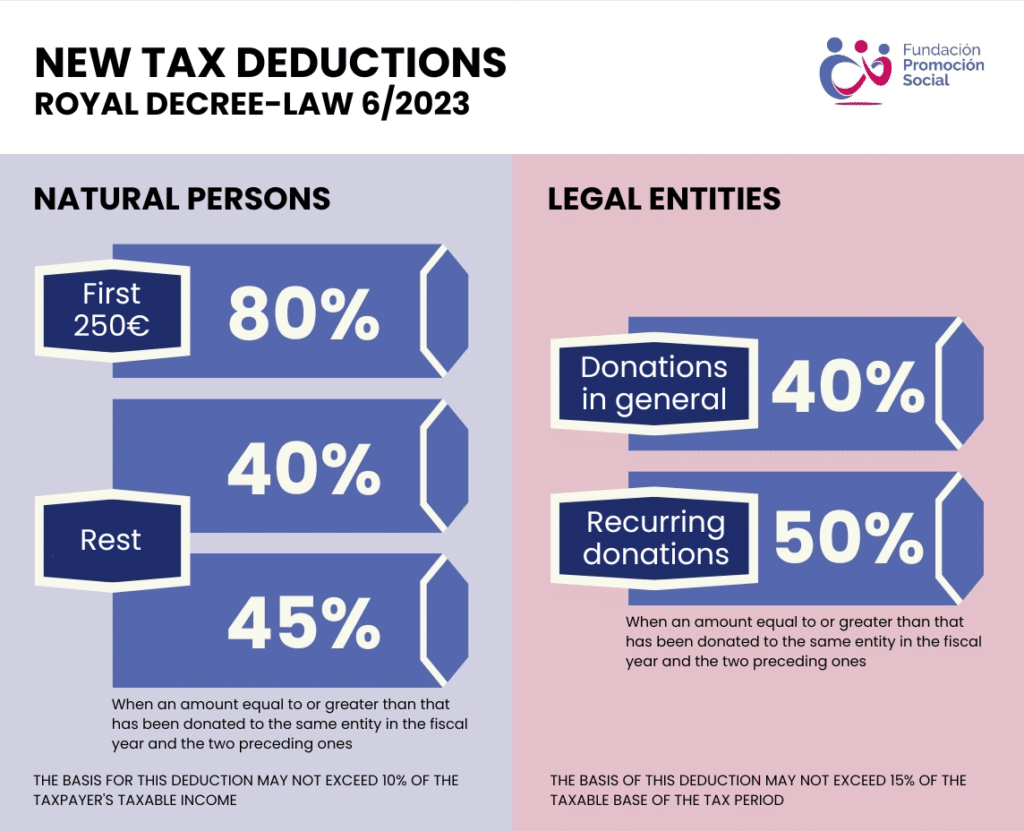

On January 10, the Congress of Deputies validated Royal Decree-Law 6/2023, of December 19, amending various articles of the Patronage Law 49/2002 which refers to the tax regime for non-profit entities. The new measures incorporated will be taken into account as from January 1, 2024.

In others, one of the main objectives of these amendments is to promote the collaboration of the private sector with non-profit organizations. Thus, one of the most significant measures has to do with the improvements in the IRPF and IS deduction rates, as well as in the IRNR (Non-Resident Income Tax) for people who make contributions to this type of non-profit entities.

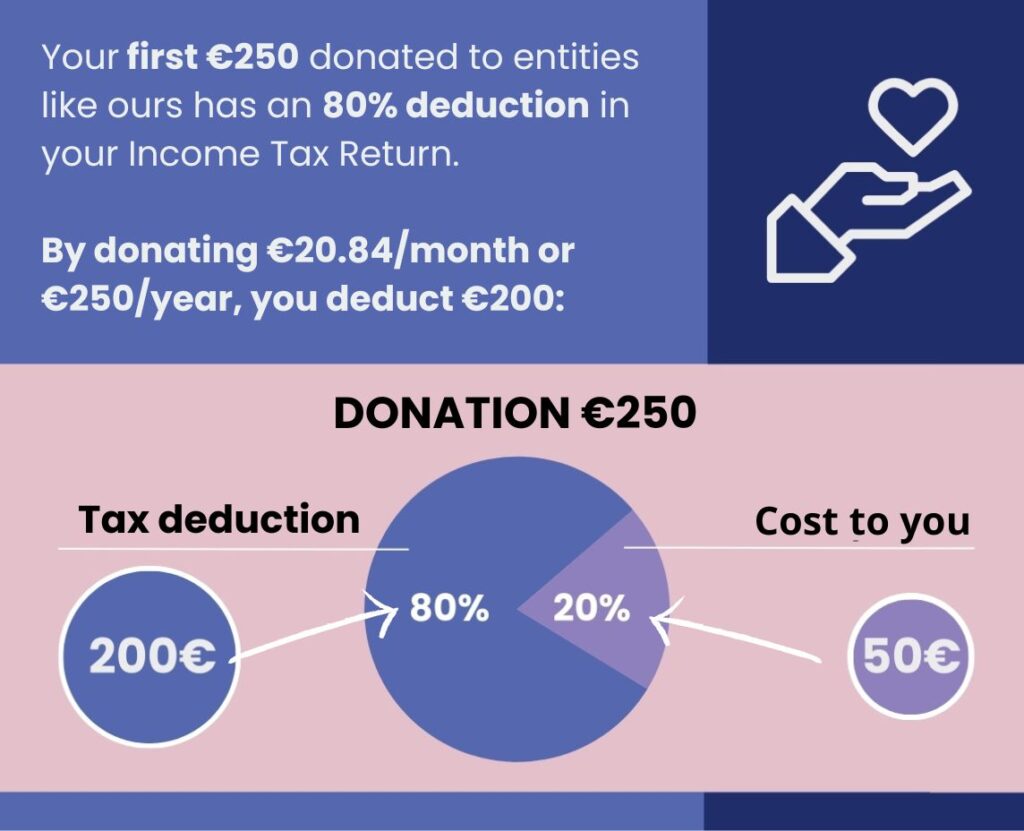

The deduction percentages are as follows:

You collaborate, they build, everyone wins

We begin 2024 with many projects, initiatives and enthusiasm to continue working to improve the dignity and lives of people in all the countries in which our Foundation is present, including Peru, Guatemala, Bolivia, Palestine, Lebanon, Jordan, Egypt, Ethiopia, Kenya, Uganda…

At the Foundationl, our efforts are focused on offering all possible opportunities to these people so that, in turn, they are able to improve and develop their living conditions, those of their families and, therefore, those of their communities, in a sustainable and sustained manner over time.

To achieve this, our dedication alone is not enough. Your collaboration, by becoming a member or donating, is also key and fundamental for us to continue reaching so many people and families around the world.

Last year, together, we managed to support more than 150,000 people. This 2024 we would like to increase this number, can you help us?